The Reality Check Your Paycheck Needs (And Your Boss Hopes You’ll Never Do)

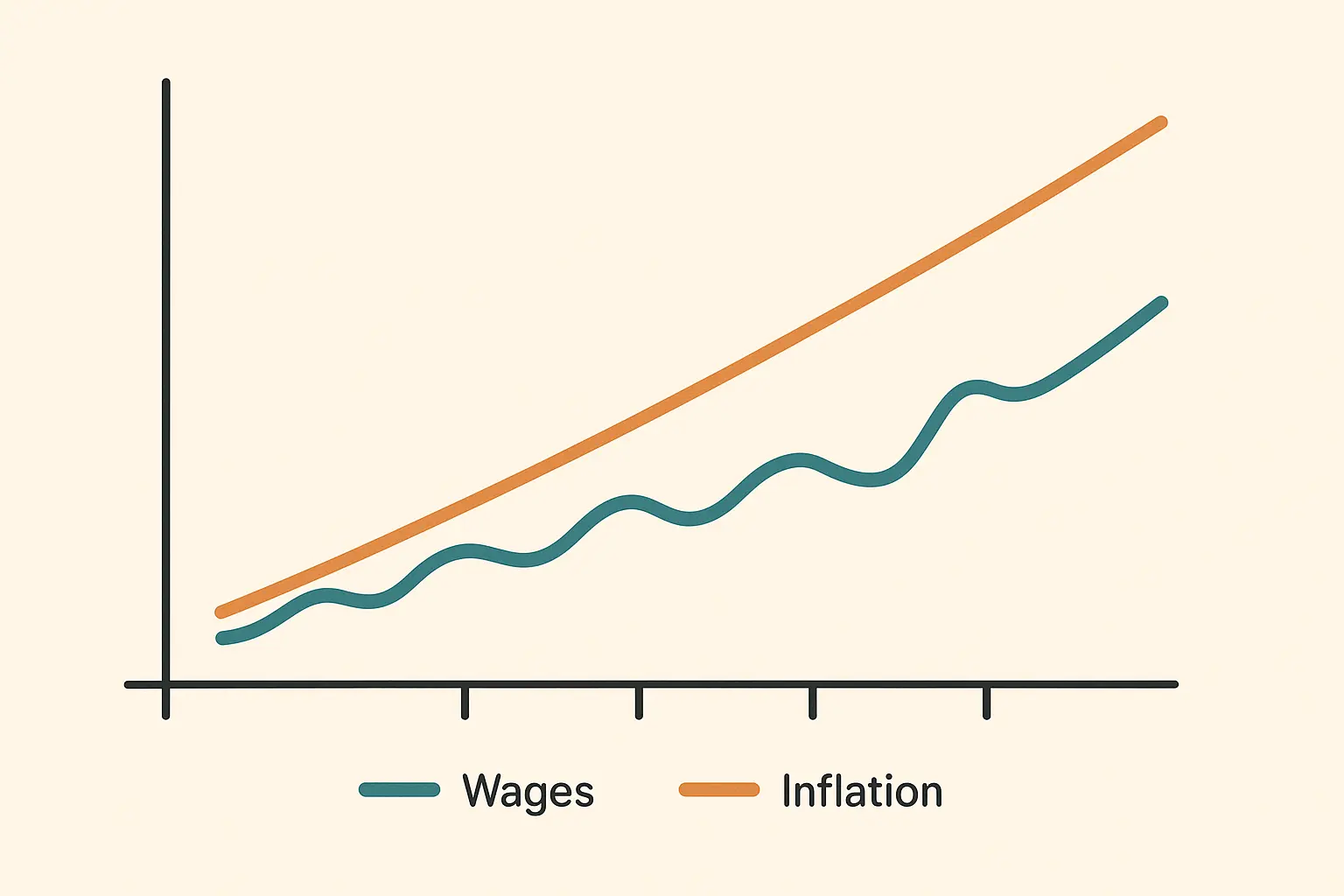

That 3% raise you celebrated last month? It might actually be a pay cut in disguise. While you’re doing a happy dance about your “promotion,” inflation could be quietly eating away at what your money can actually buy.

I learned this the hard way when I realized my supposedly impressive salary growth over five years had actually left me with less buying power than when I started. That stung. But once I figured out how to use a salary inflation calculator to see what my money was really worth, everything changed.

Table of Contents

-

Why This Matters More Than You Think

-

The Harsh Truth About Your “Raise”

-

The Tools That Actually Work (No PhD Required)

-

How to Use This Knowledge Like a Pro

-

The Math That Actually Matters (And Won’t Make Your Head Spin)

-

Industry Secrets Nobody Talks About

-

Advanced Strategies That Actually Work

-

Putting It All Together: Your Action Plan

TL;DR

-

Your salary increases might be shrinking your buying power if they’re not beating inflation rates

-

A salary inflation calculator reveals whether you’re actually getting ahead or falling behind financially

-

Manual calculations using CPI data give you more control than basic online tools

-

Industry-specific inflation patterns can guide your career decisions and timing for job changes

-

Salary negotiation becomes way more powerful when you’ve got inflation-adjusted data backing your requests

-

Geographic differences in inflation rates affect your real earnings more than you probably realize

Why This Matters More Than You Think

Look, I get it. Math isn’t everyone’s favorite subject, and “salary inflation calculators” sounds about as exciting as watching paint dry. But here’s the thing—understanding this stuff is the difference between thinking you’re getting ahead and actually building wealth.

Since 1913, inflation in the U.S. has averaged 3.27% annually. That means if your raise is anything less than that, you’re literally making less money than before, even though your paycheck looks bigger.

Most people celebrate salary increases without realizing they might actually be losing money. Understanding salary inflation fundamentals goes beyond crunching numbers—it’s about seeing through the illusion of nominal wage growth to understand what your paycheck actually buys you.

The Harsh Truth About Your “Raise”

Let me tell you about Sarah. She got a $1,800 raise in 2022—bumping her salary from $60,000 to $61,800. She was thrilled. Who wouldn’t be?

But here’s what nobody told her: inflation that year hit 9%. To maintain the same buying power, she would have needed her salary to jump to $65,400. Instead of getting ahead, she actually lost about $3,600 in purchasing power.

This happens all the time. Companies give out raises that sound generous but actually decrease your standard of living. They’re not necessarily being sneaky—they might not realize it either. But you need to know.

Real vs. Nominal Salary Changes: The Brutal Truth

Here’s what nobody tells you: that $5,000 raise you got last year might have actually decreased your buying power. Nominal salary increases show the raw dollar amount added to your paycheck, while real salary changes reveal what that money can actually purchase after accounting for inflation.

When evaluating salary increases, it’s essential to consider them alongside other compensation factors. Our comprehensive guide on salary increase calculator secrets provides additional tools for understanding the true value of your compensation changes.

Learning to distinguish between these two measurements transforms how you evaluate job offers and career progression. I always run the numbers through a salary inflation calculator before getting excited about any salary change. The results can be sobering, but they’re also empowering because they give you the real story about your financial progress.

How Consumer Price Index Becomes Your Secret Weapon

The Consumer Price Index isn’t just government bureaucracy—it’s the foundation that makes salary inflation calculations possible. CPI tracks the average change in prices for goods and services over time, providing the baseline measurement that converts your historical earnings into today’s dollars.

The Consumer Price Index has been calculated every year since 1913 by the Bureau of Labor Statistics, reflecting changes in prices of all goods and services purchased by urban households, which make up about 87% of the total U.S. population. SmartAsset

When you master CPI data, you can use any salary inflation calculator more effectively. You’ll understand what the numbers mean and spot when calculators are using questionable data sources or flawed methodologies.

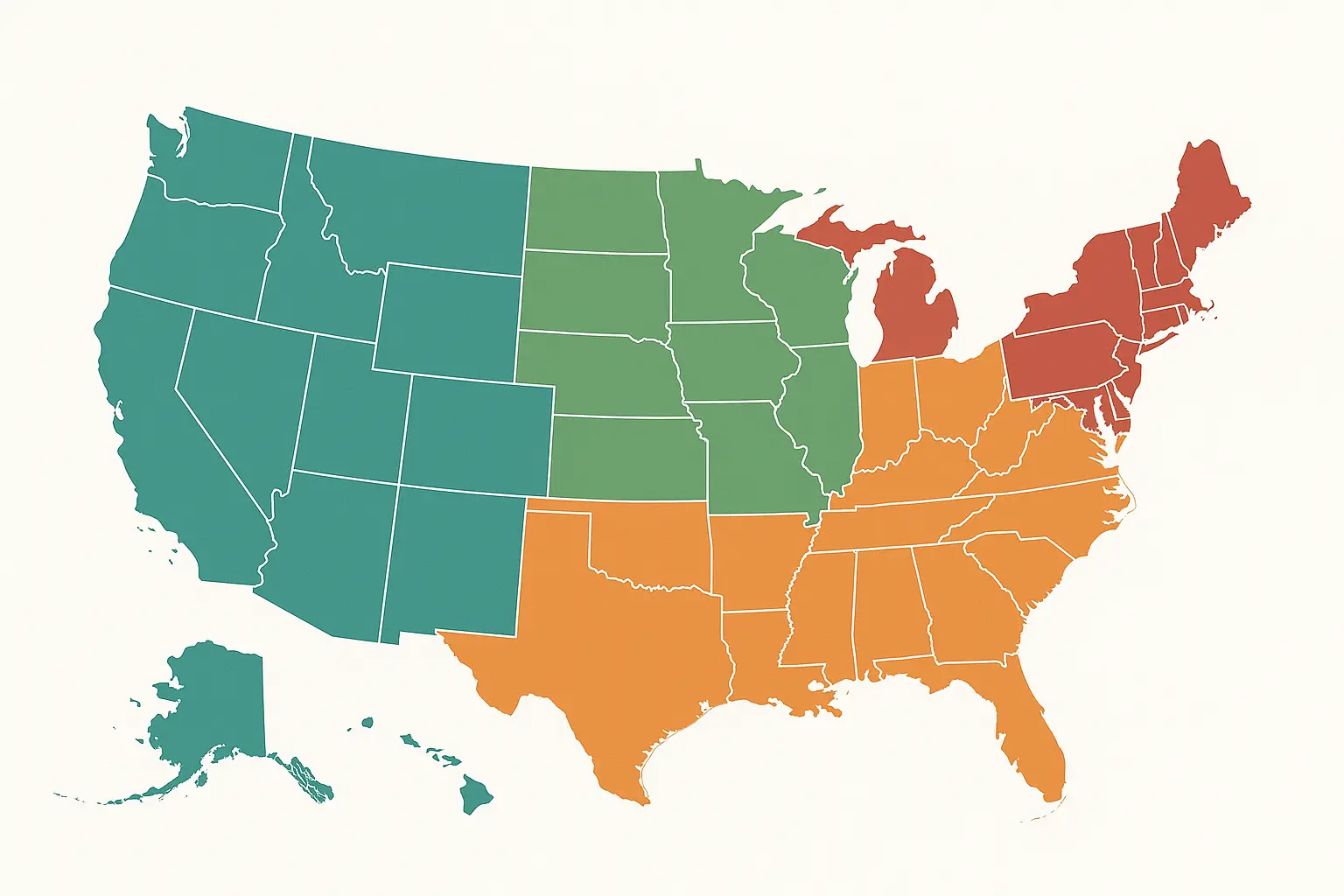

Regional Inflation Variations That Nobody Talks About

Inflation doesn’t hit every city the same way, and this geographic variation can dramatically affect your real earnings. A $80,000 salary in Austin might lose purchasing power faster than the same amount in Cleveland due to different regional inflation rates.

These variations become especially important when you’re comparing job opportunities across different metropolitan areas or considering relocation for career advancement. I’ve seen people take jobs in expensive cities thinking they were getting ahead, only to discover their purchasing power actually decreased despite the higher nominal salary.

The Tools That Actually Work (No PhD Required)

Forget the complicated economic theories. Here’s what you actually need to know:

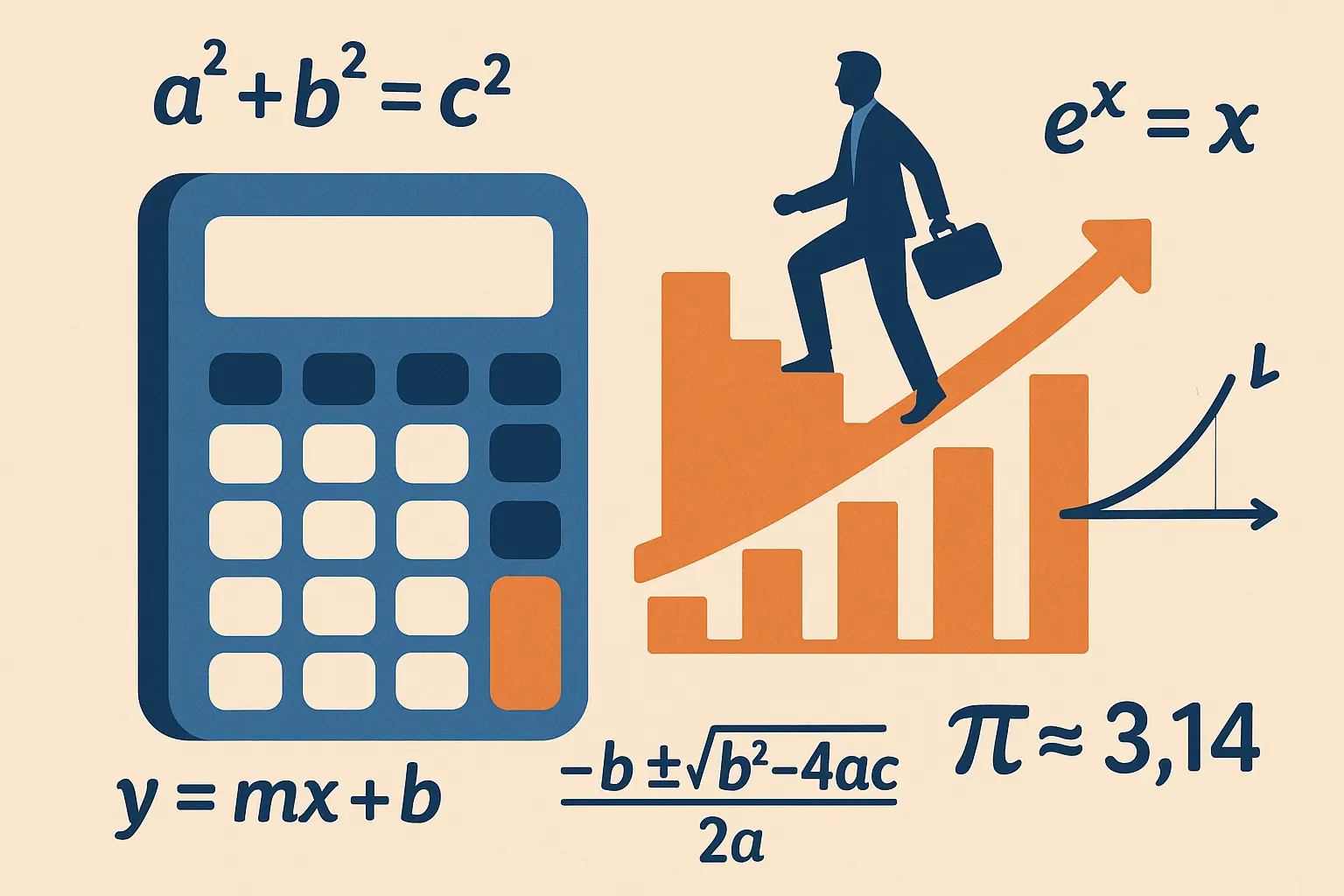

The Simple Formula That Changes Everything

Ready for this? It’s easier than you think:

(Your Old Salary × Current Year’s CPI) ÷ Old Year’s CPI = What You Should Be Making Now

That’s it. No advanced calculus, no economic degree needed.

For example: If you made $50,000 in 2010, here’s what that’s worth today:

($50,000 × 310.3) ÷ 218.1 = $71,156

So if you’re making less than $71,156 now, you’ve actually gone backward financially.

Online Calculators: The Good, Bad, and Ugly

Not all salary inflation calculators are created equal. Here’s what to look for:

-

Uses official Bureau of Labor Statistics data

-

Shows their sources (if they’re hiding them, run)

-

Updates regularly

-

Goes back to at least 1913

My favorites? The Bureau of Labor Statistics has a solid one, and SmartAsset’s is pretty reliable too.

Beyond basic inflation calculations, professionals need comprehensive salary analysis tools. Our detailed review of after-tax salary calculators complements inflation analysis by showing your true take-home purchasing power after taxes and deductions.

Salary Inflation Calculator Evaluation Checklist:

-

Uses official Bureau of Labor Statistics CPI data

-

Provides source citations and methodology

-

Allows customization of time periods and regions

-

Shows both nominal and real value calculations

-

Includes margin of error or confidence intervals

-

Updates data regularly (monthly or quarterly)

-

Offers historical data back to at least 1913

Data Source Verification That Protects Your Decisions

The accuracy of your salary inflation calculations depends entirely on the quality of underlying data sources. Reliable calculators use official government inflation data from the Bureau of Labor Statistics Consumer Price Index, while questionable tools might rely on incomplete or biased datasets.

I always verify data sources before trusting any salary inflation calculator results. This verification process has saved me from making career decisions based on flawed information multiple times.

Learning to verify data sources ensures your calculations reflect economic reality rather than someone’s agenda. The difference between official government data and privately compiled statistics can be significant enough to change your career decisions.

How to Use This Knowledge Like a Pro

In Salary Negotiations

Instead of walking into your boss’s office saying “I deserve more money” (which sounds whiny), try this:

“Based on inflation data, my salary has lost 6% of its purchasing power since my last raise. To maintain the same standard of living, I’d need to be making $X.”

See the difference? You’re not asking for a favor—you’re presenting a business case.

Salary inflation calculations provide compelling evidence in salary negotiations, demonstrating the need for adjustments based on economic realities rather than personal desires. Using this data strategically transforms salary discussions from emotional appeals into fact-based business conversations.

Successful salary negotiations require multiple strategies working together. Our comprehensive guide on how to ask for a raise strategy provides the communication framework to present your inflation-adjusted data effectively during compensation discussions.

When Evaluating Job Offers

That $80,000 offer in San Francisco might sound amazing until you realize it has the same buying power as $45,000 in Cleveland. Regional inflation matters more than most people think.

Regional compensation data shows significant variations, with private industry employer costs ranging from $39.94 per hour in the South to $56.67 in the Northeast as of June 2025, highlighting the importance of geographic market analysis in salary negotiations. “Regional compensation costs vary significantly across U.S.” Bureau of Labor Statistics

For Career Planning

Some industries consistently beat inflation; others don’t. Tech salaries often outpace inflation significantly. Retail? Not so much. This knowledge helps you make smarter long-term career decisions.

Understanding your industry’s specific inflation relationship helps you make smarter long-term career decisions. I always research historical patterns before making major career moves, and this research has saved me from several potentially costly mistakes.

The Math That Actually Matters (And Won’t Make Your Head Spin)

Here’s the thing about salary inflation math—it’s not nearly as scary as it sounds. You don’t need to be a Wall Street analyst to figure this out.

The Three Numbers You Need to Track

-

Your salary then

-

Your salary now

-

The inflation rate between those years

That’s literally it. Everything else is just fancy window dressing.

Manual Calculations: Why Bother?

Look, I know online calculators are easier. But here’s why I do the math myself sometimes:

-

You catch mistakes: I’ve seen salary inflation calculators spit out numbers that were obviously wrong

-

You understand what’s happening: Instead of just trusting a black box

-

You can customize: Maybe you want to factor in regional differences or industry-specific inflation

Step-by-Step (For Real This Time)

Step 1: Get Your Data

-

Bureau of Labor Statistics website (it’s free)

-

Your old pay stubs or tax returns

-

A calculator (your phone works fine)

Step 2: Plug and Chug

Remember that formula? Here it is again:

(Old Salary × Current CPI) ÷ Old CPI = Inflation-Adjusted Salary

Step 3: Compare and Cry (Or Celebrate)

If your current salary is higher than the result, you’re winning. If not… well, now you know why everything feels more expensive.

The Base Year Adjustment Formula That Changes Everything

Master this formula and you’ll never wonder about historical salary values again: (Historical Salary × Current CPI) ÷ Historical CPI = Inflation-Adjusted Salary. This calculation converts any historical salary into current purchasing power, but knowing when to apply different base years makes the difference between accurate analysis and misleading results.

|

Calculation Component |

Formula Element |

Example Value |

|---|---|---|

|

Historical Salary |

Starting salary amount |

$45,000 (2015) |

|

Current CPI |

Latest CPI-U value |

310.3 (2024) |

|

Historical CPI |

CPI for base year |

237.0 (2015) |

|

Inflation-Adjusted Salary |

($45,000 × 310.3) ÷ 237.0 |

$58,937 |

Purchasing Power Parity Calculations Made Simple

Purchasing power parity calculations answer the question everyone wants to know: what would my grandfather’s 1975 salary be worth today? These cross-temporal value comparisons account for changes in goods and services costs over time, revealing the true buying power of historical wages.

The cumulative inflation rate from January 1990 to January 2019 was approximately 97.58%, meaning that $100 in 1990 would need to be nearly $198 in 2019 to maintain the same purchasing power. SmartAsset

When I run these calculations using a salary inflation calculator, the results often shock people. Salaries that seemed impressive decades ago might be worth less in today’s dollars than entry-level positions in the same field.

Industry Secrets Nobody Talks About

Some Industries Are Inflation-Proof (Sort Of)

Tech companies? They usually stay ahead of inflation. Healthcare? Hit or miss. Retail and hospitality? Often struggle to keep up.

This isn’t just random—it’s based on decades of data. When I was choosing between a marketing role at a tech company versus a traditional retailer, this knowledge helped me pick the path that would actually grow my wealth.

Recent data shows significant regional wage variations, with compensation costs for private industry workers increasing 4.7 percent in the Seattle-Tacoma area compared to the national average of 3.5 percent for the year ending June 2025. “Seattle area sees higher wage growth than national average” Bureau of Labor Statistics

Geographic Reality Check

A $100,000 salary in New York City has the buying power of about $44,000 in Birmingham, Alabama. But here’s what’s wild—the inflation rates in these cities are different too.

Some cities see their costs rise faster than others. Austin, for example, has seen crazy cost increases lately. Cleveland? More stable. This affects your real earnings way more than most people realize.

Timing Your Career Moves

Here’s something most career advisors won’t tell you: there are better and worse times to switch jobs based on inflation cycles. During high inflation periods, companies are often more willing to give significant raises to prevent turnover.

I’ve timed two major job changes during inflationary periods and negotiated much better packages because of it.

Advanced Strategies That Actually Work

The “Inflation Insurance” Negotiation

When negotiating salary, ask for annual cost-of-living adjustments tied to CPI. Not all companies will agree, but the ones that do are usually worth working for long-term.

Benefits Inflation Math

Your health insurance premium going up 8% while your salary goes up 3%? That’s a double whammy. Factor benefit cost increases into your salary inflation calculator analysis for the full picture.

Investment Implications

If your salary isn’t keeping up with inflation, your investment strategy needs to compensate. This might mean being more aggressive with your portfolio or finding side income streams.

Future inflation calculations typically assume a 2.5% future inflation rate based on the average of the last 25 years, though this can be adjusted based on economic conditions and Federal Reserve policy changes. SmartAsset

Putting It All Together: Your Action Plan

Monthly Reality Check

Once a month, I spend 15 minutes updating my inflation-adjusted salary tracking using a reliable salary inflation calculator. Sounds nerdy, but it keeps me grounded about my real financial progress.

Annual Career Review

Every year, calculate whether your salary growth beat inflation. If it didn’t, that’s your cue to either negotiate or start looking elsewhere.

Resume Upgrades

Instead of saying “Increased salary by 15% over three years,” try “Achieved 8% real salary growth above inflation, demonstrating consistent value creation.”

See how much stronger that sounds? You’re not just listing facts—you’re showing you understand business and economics.

When showcasing your career progression, professional presentation matters as much as the data itself. Our guide to professional resume format helps you present your inflation-adjusted achievements in a visually compelling way that catches employer attention.

Future Planning

Use inflation projections (usually around 2-3% annually) to set realistic salary goals. If you want to improve your standard of living by 2% per year, you need raises of 4-5% annually.

|

Career Decision Factor |

Inflation-Adjusted Analysis |

Weight (1-10) |

|---|---|---|

|

Base Salary Growth |

Compare real vs. nominal increases |

9 |

|

Geographic Cost Differences |

Regional inflation rate variations |

8 |

|

Industry Growth Trends |

Historical sector performance vs CPI |

7 |

|

Benefits Value Changes |

Healthcare/retirement cost inflation |

6 |

|

Skill Development ROI |

Training investment vs. salary gains |

5 |

Opportunity Cost Analysis That Reveals Hidden Truths

Calculating the real cost of career decisions requires comparing inflation-adjusted earning potential across different paths and timeframes. This analysis reveals the true financial impact of career choices, including the hidden costs of staying in positions where salaries lag behind inflation.

Understanding opportunity costs helps you make career moves that maximize long-term financial growth. I regularly perform these calculations to ensure I’m not missing better opportunities or staying too long in positions that aren’t advancing my economic position.

The hidden costs of career inaction often exceed the risks of making strategic moves. When you can quantify these costs using a salary inflation calculator, the decision-making process becomes much clearer.

Common Mistakes That Cost You Money

The “Percentage Trap”

A 5% raise sounds great until you realize inflation was 6% that year. Always compare your raise to the inflation rate, not to zero.

Ignoring Regional Differences

Moving from Denver to San Francisco for a 40% salary bump might actually be a pay cut once you factor in cost differences and regional inflation rates.

Focusing Only on Base Salary

Total compensation includes benefits, stock options, retirement contributions—all of which have their own inflation rates. A company might freeze salaries but increase 401k matching to compensate.

Tools and Resources That Don’t Suck

Reliable Calculators

-

Bureau of Labor Statistics CPI Inflation Calculator

-

SmartAsset Inflation Calculator

-

Minneapolis Fed’s “What is a dollar worth?” tool

Data Sources You Can Trust

-

Bureau of Labor Statistics (BLS.gov)

-

Federal Reserve Economic Data (FRED)

-

Your own employment records

Red Flags to Avoid

-

Calculators that don’t show their data sources

-

Tools that haven’t been updated in years

-

Anything that seems too good to be true

Turning Numbers Into Career Gold

Using inflation-adjusted salary data helps you better articulate career progression and value proposition in resumes and professional profiles. Instead of just listing job titles and responsibilities, you can demonstrate genuine career advancement through real purchasing power growth.

Achievement Quantification That Impresses Employers

Presenting salary progression in inflation-adjusted terms shows genuine career advancement rather than just nominal increases that may not reflect real growth. This sophisticated approach to quantifying achievements demonstrates financial literacy and strategic thinking that employers value.

Professional Achievement Documentation Template:

-

Calculate inflation-adjusted salary growth for each role

-

Identify periods of above-inflation compensation increases

-

Document market conditions during salary negotiations

-

Quantify skill development ROI in real dollar terms

-

Compare your growth to industry inflation benchmarks

Skill Investment ROI Analysis for Smart Development Choices

Calculating the inflation-adjusted return on investment for professional certifications, education, and skill development helps you prioritize learning opportunities based on historical salary data. Some skills and certifications consistently lead to salary increases that outpace inflation, while others provide minimal real economic benefit.

This analysis ensures your professional development investments generate actual purchasing power growth. I evaluate every training opportunity and certification program using this framework before committing time and money.

Converting hourly wages to salary equivalents is crucial for comprehensive compensation analysis. Our detailed guide on salary to hourly calculator helps you compare different compensation structures when evaluating inflation-adjusted earning potential across various job opportunities.

Resume Builder IQ’s AI-powered platform helps you translate these salary inflation insights into compelling resume content that showcases your market awareness and career progression. When you understand your real earning trajectory, you can better articulate your value proposition using industry-specific templates that highlight your economic growth and strategic thinking.

The Bottom Line

Look, understanding salary inflation isn’t going to make you rich overnight. But it will stop you from making expensive mistakes and help you make career decisions based on reality instead of wishful thinking.

The professionals who build real wealth over their careers aren’t necessarily the smartest or most talented—they’re the ones who understand these economic fundamentals and use them consistently. Understanding salary inflation goes beyond satisfying curiosity—it’s about taking control of your financial future and making career decisions based on economic reality rather than nominal numbers.

Your paycheck is probably your biggest wealth-building tool. Don’t you think it’s worth spending a little time understanding what it’s actually worth?

Start tracking this stuff today using a reliable salary inflation calculator. Six months from now, you’ll be amazed at how differently you view every career opportunity that comes your way. And your future self will thank you for finally paying attention to what your money can actually buy.

Your career deserves the same analytical rigor you’d apply to any major financial decision. Whether you’re negotiating your next raise, evaluating a job offer, or planning a career change, salary inflation analysis provides the foundation for making choices that actually improve your economic position rather than just maintaining it.

The difference between professionals who build real wealth and those who just keep up with expenses often comes down to understanding these economic principles and applying them consistently throughout their careers. Start using these insights today, and you’ll be amazed at how differently you view every career opportunity that comes your way.