After Tax Salary Calculator: The Real Numbers Behind Your Paycheck (And Why Most People Get It Wrong)

Got your first “real job” paycheck and wondered where half your salary went? You’re not alone. That shiny $75,000 offer suddenly becomes $4,680 a month after taxes, and now you’re eating ramen instead of celebrating your success.

Here’s what actually happens to your paycheck: Uncle Sam takes his cut first, then your state wants a piece, and don’t forget about Social Security and Medicare. By the time everyone’s done, your “big” salary looks pretty different. The 2025 tax brackets and the new W-4 form (its first major change since 1987) make understanding these calculations more crucial than ever.

Table of Contents

-

Why Your Paycheck Looks Nothing Like Your Salary

-

The Three Tax Monsters Eating Your Money

-

Calculator Tools That Actually Work

-

Complex Pay Situations Nobody Talks About

-

Smart Strategies to Keep More of Your Money

-

Final Thoughts

TL;DR

-

Your gross salary is basically marketing – your net pay determines whether you can afford that apartment

-

Pre-tax deductions like 401(k) contributions are your secret weapon for keeping more money

-

Moving from California to Texas could put thousands more in your pocket annually without changing jobs

-

Good calculators handle the complex stuff automatically – no math degree required

-

Strategic benefit choices can boost your take-home pay without getting a raise

-

Bonuses get taxed like you won the lottery – plan accordingly

Why Your Paycheck Looks Nothing Like Your Salary

Let me tell you about my friend Sarah. She got excited about her $75K marketing job until her first paycheck hit. She’d already signed a lease based on her gross pay and suddenly realized she was $1,600 short every month. Don’t be Sarah.

That salary offer letter shows gross pay because it looks impressive, but it’s essentially meaningless for your actual life. Gross pay is what you earn before reality kicks in – before taxes, before benefits, before you realize you can’t actually afford that lifestyle you planned.

Here’s What Actually Happens to Your Money

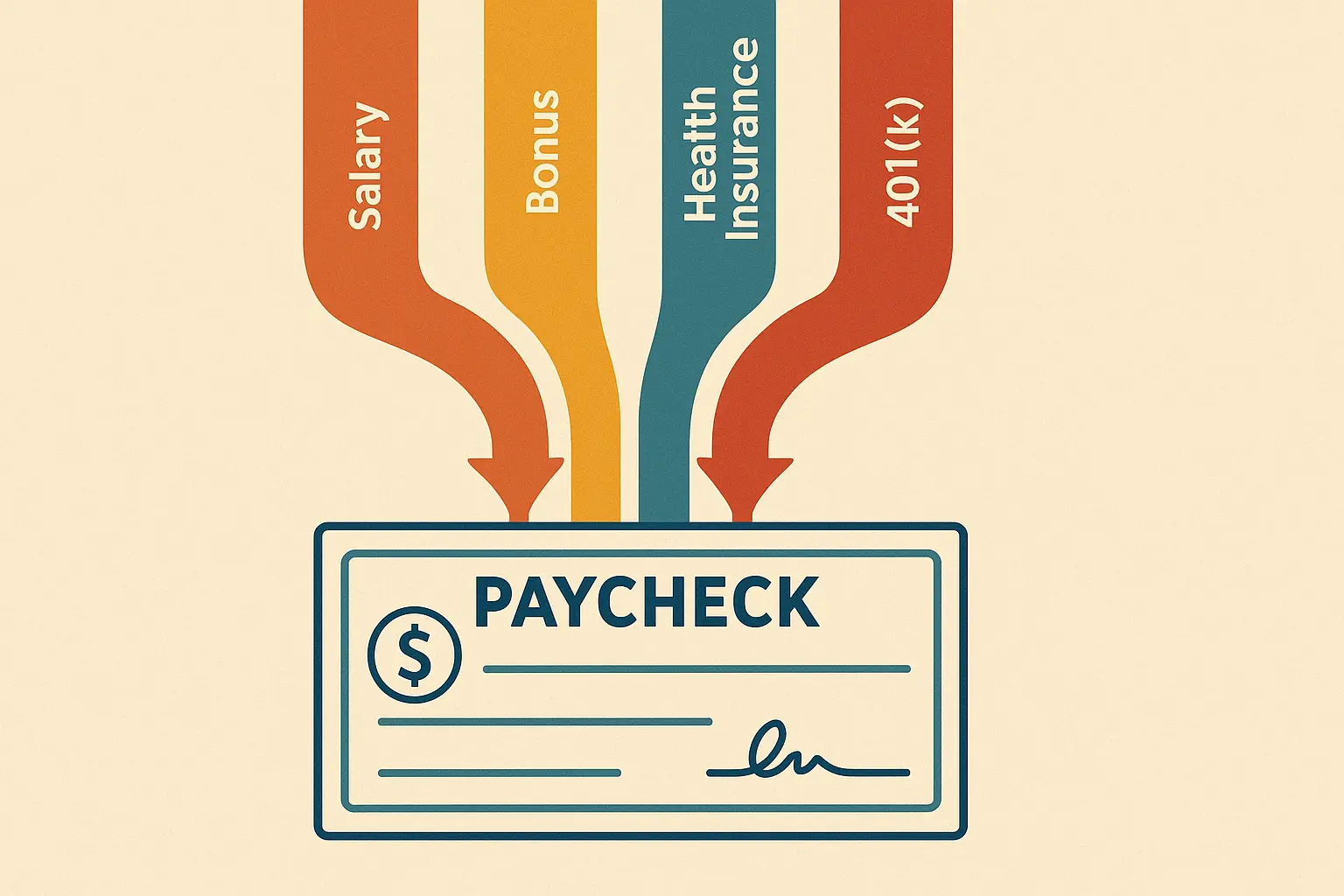

Every paycheck follows the same brutal sequence, and the order matters more than you think. First, your pre-tax stuff comes out (401k, health insurance) – this actually helps you because it lowers what gets taxed. Then the government takes its cut through federal, state, and payroll taxes. Finally, any post-tax deductions (like Roth IRA contributions) come out of what’s left.

Understanding this sequence is crucial because it shows you where you have control. Pre-tax deductions happen first, which means they reduce the amount that gets taxed. It’s like getting a discount on your taxes.

When evaluating job offers, understanding your true take-home pay becomes even more critical if you’re considering how to ask for a raise in your current position versus accepting a new opportunity.

Sarah’s reality check looked like this: $75,000 salary minus $18,000 in federal taxes (22% bracket), $6,975 in California state taxes (9.3%), $5,738 in payroll taxes (7.65%), and $4,800 in pre-tax benefits. Her actual take-home? $56,160 annually, or $4,680 monthly – nearly $1,600 less than she expected.

Pre-tax vs Post-tax: Your Secret Weapon

This is where you can actually fight back. Pre-tax deductions reduce your taxable income, meaning you pay less in taxes overall. Post-tax deductions come from money that’s already been taxed, but they can offer different long-term benefits.

Here’s the breakdown that matters:

Pre-tax wins: 401(k), health insurance, HSA contributions

-

Save you money NOW by lowering your tax bill

-

$10,000 contribution saves you $2,200 in taxes (22% bracket)

Post-tax plays the long game: Roth IRA, life insurance

-

No immediate tax savings

-

Potential tax-free growth later

The golden rule: Max out your pre-tax options first, especially if your employer matches 401(k) contributions. That’s free money you can’t afford to leave on the table.

The Deduction Order That Controls Your Life

Your after tax salary calculator needs to follow this exact sequence or the numbers will be wrong:

-

Start with gross salary

-

Subtract pre-tax deductions (401k, health insurance, HSA)

-

Calculate federal income tax on what’s left

-

Calculate state income tax (if your state has one)

-

Subtract payroll taxes (Social Security 6.2%, Medicare 1.45%)

-

Subtract post-tax deductions

-

What’s left is your actual spending money

Any calculator that doesn’t follow this order will give you fantasy numbers that don’t match your real paycheck.

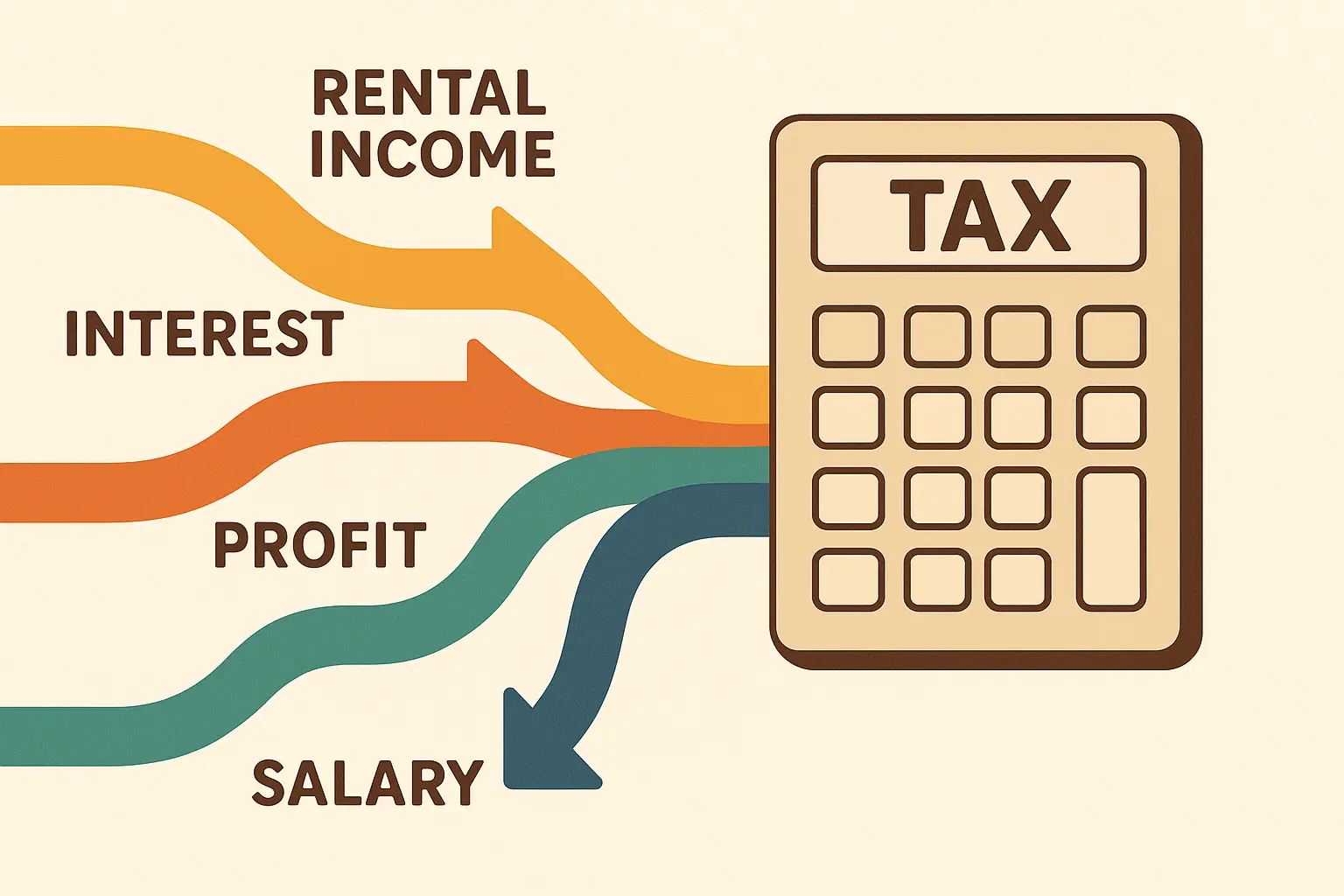

The Three Tax Monsters Eating Your Money

Three different tax systems are competing for your paycheck, each with its own rules and appetite for your money. Understanding how they work helps you make smarter decisions about where to live and how to structure your pay.

Recent tax changes have made these calculations more predictable. President Donald Trump signed the One Big Beautiful Bill Act into law on July 4, ushering in an estimated $4.5 trillion in tax cuts according to SmartAsset. This makes the 2017 tax brackets permanent, so you can plan without worrying about major changes every few years.

Federal Income Tax: The Biggest Bite

Federal income tax uses a progressive system where different chunks of your income get taxed at different rates. You don’t pay your top rate on everything – just on the income that falls into each bracket.

Someone earning $100,000 doesn’t pay 24% on the entire amount. They pay 10% on the first $11,000, 12% on the next chunk, and so on. This is why good after tax salary calculators are essential – the math gets complicated fast.

The current brackets are 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Most middle-class earners fall into the 12% or 22% brackets, which is where strategic pre-tax contributions can really save you money.

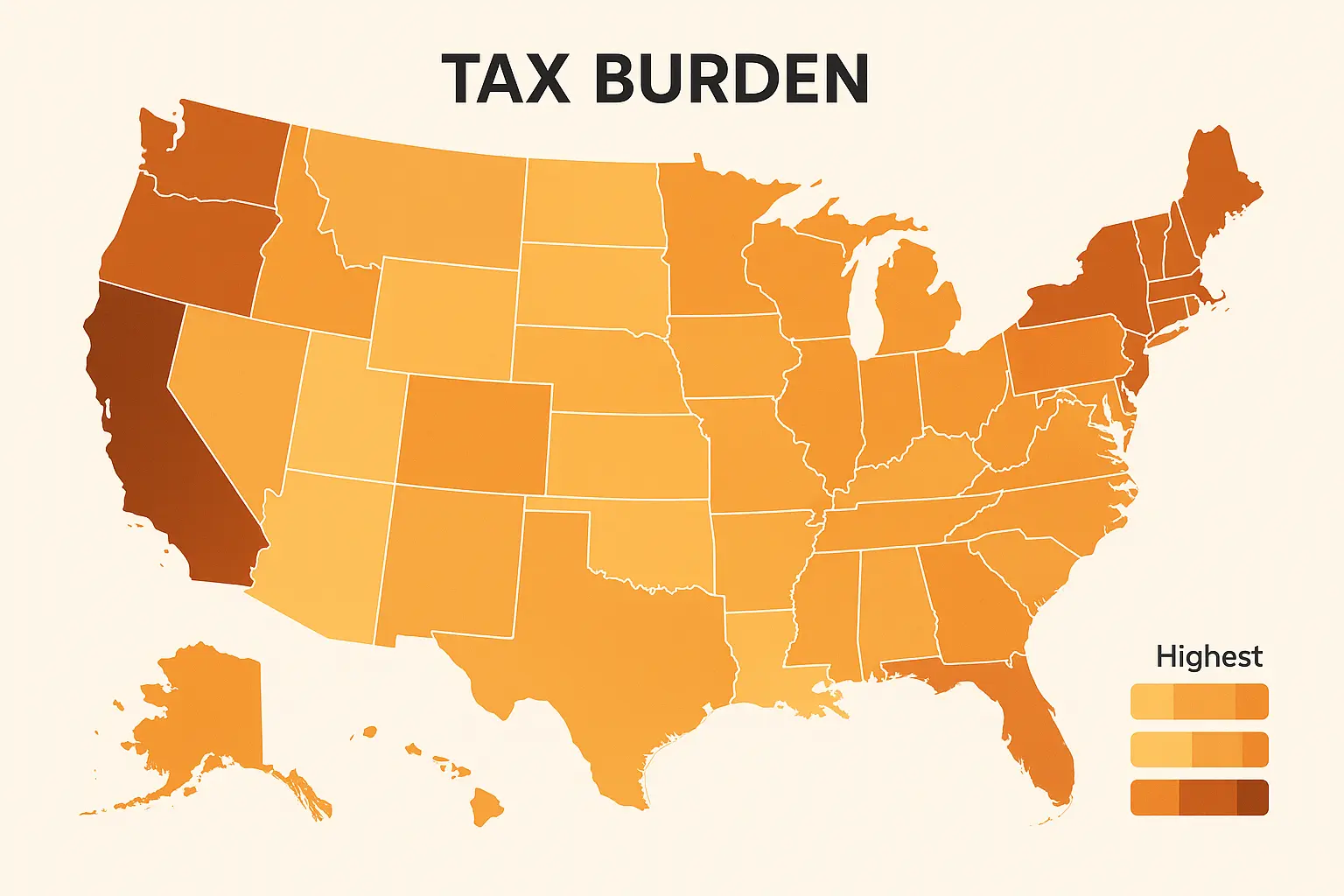

State Tax Roulette: Location Matters

Your zip code dramatically affects your take-home pay. Some states are generous (looking at you, Texas and Florida), while others will gladly take a big chunk of your dreams (California, I’m talking to you).

Here’s the reality check:

No state income tax: Texas, Florida, Tennessee, Washington

-

Keep more of what you earn

-

$100K salary stays closer to $100K

High-tax states: California (up to 13.3%), New York (up to 10.9%)

-

Can cost you $6,000-$13,300 annually on a $100K salary

-

Makes that “high-paying” job less attractive

Middle ground: Most other states fall somewhere between 3-7%

Moving from California to Texas could put an extra $10,000+ in your pocket annually without changing your gross salary. Any decent after tax salary calculator needs to account for these state differences.

Payroll Taxes: The Unavoidable Reality

Social Security and Medicare taxes hit every paycheck at flat rates. You can’t optimize these away, but understanding them helps you plan better.

Social Security: 6.2% up to $160,200 (2024 limit)

-

Once you hit the cap, you stop paying for the year

-

High earners see bigger December paychecks

Medicare: 1.45% on everything, plus 0.9% extra if you make over $200K

-

No cap, ever

-

The extra 0.9% surprises many high earners

Some states add their own payroll taxes for disability insurance or family leave programs. California, New York, and others can tack on another 1-2% in state-specific deductions.

Calculator Tools That Actually Work

Today’s after tax salary calculators have evolved way beyond basic tax tables. The best ones update automatically when tax laws change, handle complex scenarios like bonuses, and can compare take-home pay across different states.

I’ve tested dozens of these tools, and the difference between basic and advanced calculators is huge. The good ones handle virtually any situation you throw at them, while the simple ones miss critical details that affect your bottom line.

Features That Actually Matter

The best calculators sync with tax databases to stay current, compare multiple locations, and model complex scenarios without making you do the math. These features transform calculators from basic tools into comprehensive planning resources.

It’s important to understand payment frequency differences too. Bi-weekly payments occur every other week and generate two more paychecks per year (26 compared to 24 for semi-monthly), as noted by Calculator.net’s take-home pay calculator. Those two extra paychecks can provide opportunities for additional savings or debt payments.

What to look for in an after tax salary calculator:

-

Updates itself when tax laws change

-

Knows your state’s tax rules

-

Handles pre-tax and post-tax deductions correctly

-

Models bonus and supplemental income scenarios

-

Compares multiple locations

-

Doesn’t make you do complex math

Red flags to avoid:

-

Hasn’t been updated in years

-

Uses generic tax rates

-

Doesn’t distinguish between pre-tax and post-tax deductions

-

Can’t handle your specific situation

Integration with Payroll Systems

Modern calculators can connect with existing payroll platforms, pulling your actual employment data for personalized calculations. This eliminates guesswork and provides calculations based on your real benefit elections and withholding choices.

The accuracy improvement from direct integration is significant. Instead of estimating your benefit costs, the calculator uses your actual data to provide precise projections. You can also model changes in real-time – adjust your 401(k) contribution and immediately see how it affects your take-home pay.

Complex Pay Situations Nobody Talks About

Standard W-2 employment is just one piece of today’s compensation puzzle. Bonuses, stock options, multiple jobs, and irregular pay schedules all require specialized approaches that can create major surprises if you don’t understand the rules.

I’ve seen people receive substantial bonuses without understanding the tax implications. The shock of seeing 40%+ withholding rates has derailed many financial plans. A quality after tax salary calculator needs to handle these scenarios accurately.

Bonus Tax Shock

The IRS treats bonuses differently from your regular salary, often resulting in higher withholding rates that can shock unprepared recipients. Understanding these rules helps you plan for the tax impact and avoid cash flow problems.

For professionals in commission-based roles, understanding bonus taxation becomes particularly important when combined with insights from salary increase calculator strategies to maximize total compensation.

Mike, a sales manager, received a $15,000 year-end bonus. His employer used the flat-rate method, automatically withholding 22% federal tax ($3,300), plus state taxes and payroll taxes. He only took home $10,200 from his $15,000 bonus. While he’ll likely get some back at tax time, the immediate cash flow impact was brutal for his holiday spending plans.

Two withholding methods employers use:

-

Flat rate: Automatic 22% federal withholding (simpler but often overwitholds)

-

Aggregate: Combines bonus with regular pay (often results in higher withholding)

Smart after tax salary calculators can model both methods so you know what to expect.

Stock Options: The Tax Complexity Champion

Equity compensation creates scenarios that most calculators can’t handle. Incentive stock options (ISOs) might trigger alternative minimum tax, while non-qualified stock options create immediate tax liability. The timing of when you exercise options can dramatically impact your tax burden.

Stock option taxation goes beyond basic payroll calculations because it involves complex AMT calculations and capital gains considerations. However, understanding the immediate payroll impact helps you plan for the cash flow hit when you exercise options.

Multiple Jobs: The Withholding Nightmare

Workers with multiple income sources face unique challenges because each employer withholds taxes as if they’re your only income source. This doesn’t account for how multiple incomes combine to push you into higher tax brackets.

The complexity has become increasingly relevant for business owners. According to the U.S. Chamber of Commerce, “Small business owners in the United States make between $83,000 to $126,000 on average, depending on their industry and location,” but many don’t take salary in the first couple of years, creating unique challenges when transitioning to traditional W-2 wages.

Multiple income tax survival guide:

-

Calculate total expected annual income from all sources

-

Determine your combined marginal tax bracket

-

Adjust W-4 withholdings at your primary job

-

Consider quarterly estimated payments for non-W-2 income

-

Set aside cash reserves for potential underpayments

Smart Strategies to Keep More of Your Money

Understanding after-tax calculations opens the door to optimization strategies that can significantly increase your take-home pay without requiring a salary increase. Through smart benefit elections, withholding optimization, and strategic timing, you can keep more of what you earn.

These strategies work particularly well when combined with understanding salary to hourly calculations to evaluate different compensation structures.

The beauty of these strategies is their immediate impact. You don’t need to wait for a promotion – you can implement many optimizations during your next open enrollment period.

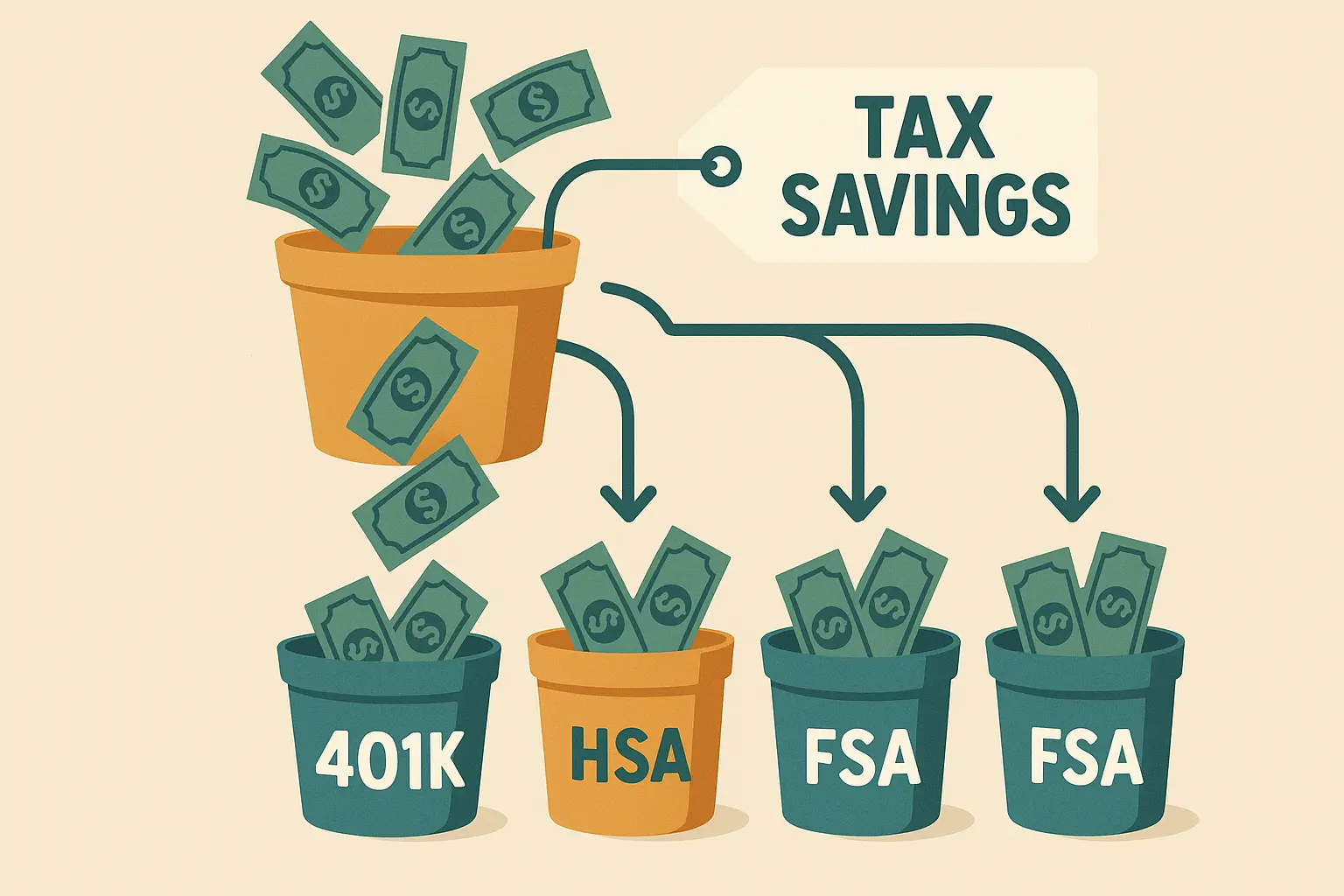

Benefit Election Mastery

Your benefit choices during open enrollment can substantially impact your take-home pay through tax advantages and employer matching. The key is maximizing tax-advantaged opportunities without creating cash flow problems.

Jennifer earns $90,000 and discovered she could optimize her take-home pay through strategic benefit elections. By maximizing her 401(k) contribution to $23,000, contributing $4,300 to her HSA, and electing $3,000 in dependent care FSA, she reduced her taxable income by $30,300. This saved her approximately $7,900 in federal and state taxes annually while building retirement and healthcare savings – effectively giving herself a raise without negotiating salary.

The optimization hierarchy:

-

401(k) to employer match – Free money, take it

-

HSA maximum – Triple tax advantage (deductible, growth, withdrawals)

-

401(k) maximum – Current tax savings

-

FSA contributions – Pre-tax dollars for predictable expenses

HSA: The Secret Weapon

Health Savings Accounts offer triple tax advantages that make them superior to traditional retirement accounts for those who can afford to pay healthcare costs out-of-pocket. Contributions are pre-tax, growth is tax-free, and qualified withdrawals are tax-free.

The advanced strategy: maximize HSA contributions while paying current medical expenses from other sources. This allows the HSA to grow tax-free for decades. After age 65, you can withdraw funds for any purpose, making it function like a traditional IRA with better tax treatment.

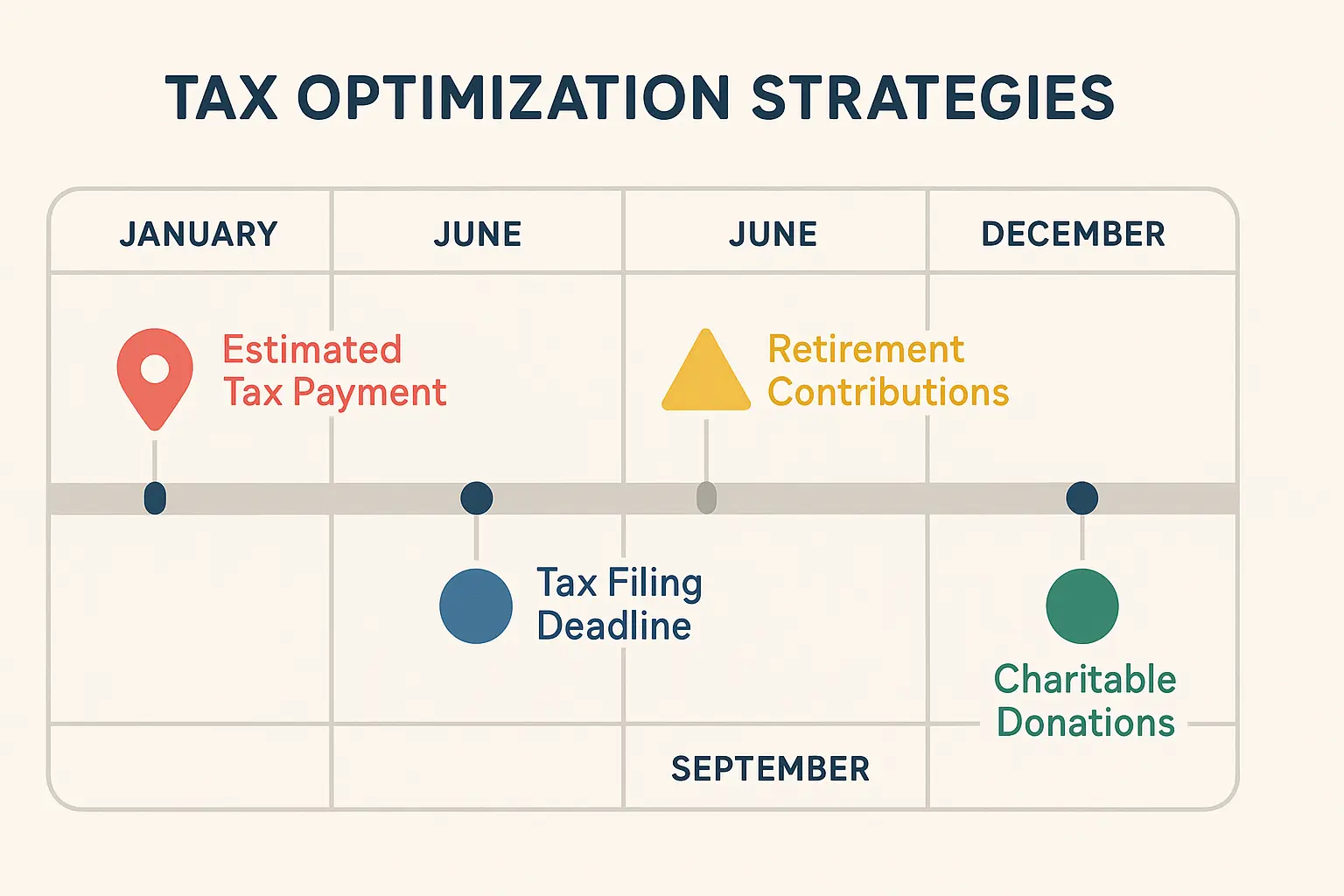

Withholding Optimization

Fine-tuning your tax withholdings improves cash flow while avoiding year-end surprises. The goal is balancing the largest possible paycheck with avoiding underpayment penalties and large tax bills.

Understanding withholding optimization becomes especially valuable for professionals exploring salary sacrifice strategies to maximize their compensation package.

The new W-4 form strategies:

-

Use dollar amounts instead of allowances for precision

-

Specify exact additional withholding or reductions

-

Update quarterly when income changes significantly

Year-end optimization opportunities:

-

Review total withholdings vs. estimated tax liability

-

Make additional 401(k) contributions if under annual limit

-

Maximize HSA contributions before December 31st

-

Adjust final paycheck withholdings if needed

Strategic Salary Negotiation Using Calculator Insights

After-tax calculations provide powerful leverage in salary negotiations by demonstrating the real value of different compensation packages. Understanding net pay implications helps you negotiate more effectively by focusing on total compensation value rather than just gross salary numbers.

When preparing for salary negotiations, combining after-tax calculations with insights on how to decline job offers professionally gives you the confidence to make informed decisions about compensation packages.

Total compensation analysis beyond salary:

-

Employer-paid health insurance (worth thousands annually in pre-tax value)

-

401(k) matching (immediate guaranteed return)

-

HSA contributions (triple tax advantage)

-

Flexible work arrangements (reduced commuting costs)

Geographic negotiation strategy:

Location-based tax differences should factor heavily into salary negotiations. A lower gross salary in a no-tax state might provide better take-home pay than a higher salary in a high-tax location, especially when combined with cost-of-living differences.

Understanding your true earning potential goes beyond calculating take-home pay – it means positioning yourself for the highest-paying opportunities available. While after-tax salary calculators help you understand what you’ll actually earn, having the right opportunities to calculate makes all the difference.

When you’re running salary calculations on potential offers, you want to ensure you’re calculating the best possible numbers. This means having access to positions at companies known for excellent compensation packages – including those valuable pre-tax benefits that significantly improve your after-tax income. Whether you’re comparing offers across different states or negotiating salary increases, starting these conversations from a position of strength with multiple opportunities makes your after-tax calculations much more meaningful.

Negotiation tactics using after-tax insights:

-

Present total compensation comparisons, not just salary

-

Highlight tax-advantaged benefits you’re willing to accept

-

Use geographic pay differences to justify location-based adjustments

-

Demonstrate understanding of the company’s total cost vs. your net benefit

Final Thoughts

After-tax salary calculators reveal the financial reality behind job offers and career decisions, transforming confusing gross numbers into actionable take-home insights. The complex interplay of taxes, deductions, and benefits doesn’t have to be mysterious when you have the right tools and understanding.

The key lies in moving beyond simple gross salary comparisons to comprehensive analysis of what actually hits your bank account. Whether you’re evaluating benefit elections, planning a geographic move, or negotiating a new position, these calculations provide the foundation for informed financial decisions that can significantly impact your quality of life.

Remember that optimization isn’t just about minimizing taxes – it’s about aligning your compensation strategy with your broader financial goals while maintaining the cash flow you need today. The most successful approach combines understanding these calculations with strategic career moves that maximize your opportunities.

Bottom line: Know your real take-home pay before you make any big financial decisions. Your future self will thank you when you’re not eating ramen in your overpriced apartment, wondering where all that “big salary” actually went.